Episode 108

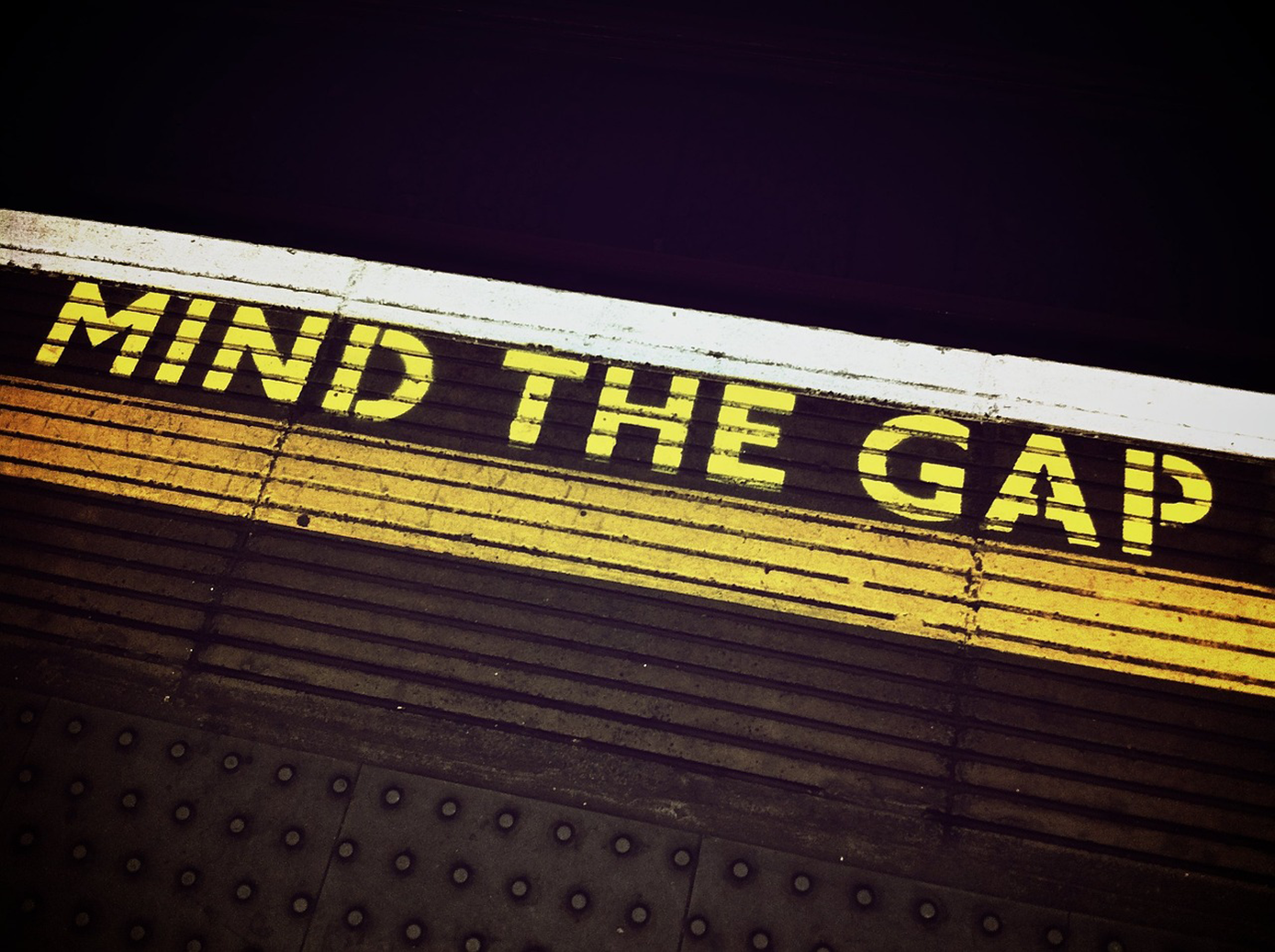

Mind the Perception Gap

How can understanding and addressing perception gaps empower your financial wellbeing?

Podcast (podcasts): Play in new window | Download (Duration: 33:33 — 76.8MB) | Embed

Exploring the impact of perception on our finances and wellbeing. From understanding how perceptions shape our financial decisions and how to challenge flawed realties connected to money. As ever some great money saving tips from #tightasstommo and a through provoking exploration that might just reshape your financial perspective.

Welcomes & Introductions

- Is David still a writer?

- Want to work with Producer Tommo and a like minded team? Come and have a chat with Ovation Finance

- The Financial Wellbeing Pulse link

What’s on Todays Podcast?

The topic of perception and how it relates to our financial wellbeing

Tight Ass Tommo

Chris’ Mum, Meany Maureen using Mental Accounting to squirrel away jam jars of money for various reasons and how you can do the same digitally.

Practical tip from Colin Lowe – use easysim.global for cheap mobile data when travelling

Do you have a #tightasstommo money saving tip you would like to share with our listeners? If so, let us know by going to Twitter @Finwellbeing or email – contact@financialwell-being.co.uk

Mind the Perception Gap

Producer Tammy came across the following and felt it needed a closer look:

Truth and perception become fused in the mind leaving no difference between the two The 22 Immutable Laws of Marketing

What does perception mean?

Perception is a process by which we take information from the world.

What we think of as reality may not be correct, our perceptions can be flawed.

How might they be flawed?

- Relying on only one source of information

- Relying on previous experiences and making assumptions

- Focus of our attention – inattentional blindness

Our perception of the information around us doesn’t always reflect reality

This perception gap is not always a bad thing

Link to Episode 104 – Crack the Happiness Code with Set Point Theory

How our perception gap with finances can be changed

How a financial planner can help challenge our assumptions and create more options

Link to Episode 107 – Making Decisions with Nick Elston

Discussion of Behavioural Biases connected to perception that can affect your financial wellbeing

Conclusions from the Guys

Episode Transcribe:

David Lloyd: Hello, everybody, and welcome to another one in our long running series. Long running, but I hope enjoyable series. A, financial wellbeing podcast. My, name is David Lloyd. I am a writer. Well, am I still a writer, actually, because I’ve recently been, made unemployed by the BBC because I was writing for this programme called Doctors for over 20 years and they’ve axed it. so am I still a writer? Yes, I am, because I’m also writing a book. So, but I’m just a different sort of writer than the writer I used to be. I’m also an actor, broadcaster. And I also host this podcast along with two other very important people, the, first of whom, who am I going to make the most important today? I’ve got two, two very, very needy people looking at me on my little screen. Me, me, me. Make me the most important and I think the neediest of all of those. Tom Morris.

Producer Tommo: Thank you. Yeah, that’s very kind of you to introduce me like that. Yeah, Tom Morris. I’m, director and charter financial planner over at Ovation Finance. I think it’s important to let you all know who sponsors this pod and who gives me the time to jump onto this. It’s the same company that Chris founded back in, Crikey, 2000, and went employee owned, in 2018, which is six years on. It’s remarkable how quickly that is passed. So, yeah, there’s my little bio.

David Lloyd: Let’S move on now to the equally needy and equally gorgeous Chris Budd.

Chris Budd: Good morning, David. Thank you for that. The financial well being pulse is a way of measuring your relationship with money so I wrote the original financial well being book, founded the Institute of Financial Wellbeing, and I’ve got something exciting that I want to just tell you about, if you’ll allow me a minute or two.

David Lloyd: You’re allowed.

Chris Budd: It’s called the financial well being pulse, something I’ve been working on for a little while now. And it’s out. It’s actually out. The idea is it’s a way of measuring your relationship with money. At the moment, it’s only available through financial advisors. So if you’re a financial advisor listening to this, get in touch. I’ll give you an email address in a bit. if you’re, a, non financial advisor, a normal person, for one of a better phrase, ask your financial advisor about it and say, please, can you sign up to the financial wellbeing pulse? The idea is that, the advisor sends the client a link. That link, accesses a series of questions, a survey, if you like, they complete that it takes about 30 questions. Takes about ten minutes. I’ve done it myself, it took me about seven minutes. And they’re quite intuitive questions. and then you get two things, you get a score, your financial wellbeing is 55% and you get a short report explaining what that means. The advisor gets a copy of that report. So the client, when they go to see the advisor, can now discuss their relationship to money and maybe start to just investigate a little bit, where it could be improved and what impact that would make a year later. Or whenever the next planning meeting happens, the process happens again and the client gets a new score. Your financial wellbeing is 65%. So now the advisor can say, we have increased your financial wellbeing by ten percentage points, which has happened as a result of our advice, which means that the firm who can gather this data on a dashboard across all their advisor and all their clients can use this in their marketing. We increase the wellbeing of our clients on average by 10%. They can give it to the FCA, the regulator, for what’s called consumer duty purposes, showing the impact of their advice. It’s dead simple, dead cheap, but I’m hoping will have a big, big impact.

David Lloyd: Well that’s absolutely fascinating. and are the questions the same every time or do they change at the following year or are they the same question?

Chris Budd: No, great question David. they’re the same, very important, so we get consistency of those results. The strength of the pulse is that it’s been developed by academics. It’s in conjunction with an organisation called centre for thriving places who’ve been measuring well being for years. it uses their core set of questions for general wellbeing and we develop with them. And also a, ah, guy called Doctor Tom Mather who’s going to be on this podcast soon of Agon. we have also developed a, ah, new set of questions specifically around money and happiness, which he added on to the centre for thriving places general set of questions. So it’s the academic rigour that this has all been produced with is its main feature. As far as I’m concerned, the M main feature for most advisors and firms I think will be the simplicity with which you can use it.

David Lloyd: Well, if you’re a financial adviser and you’re not already clamouring for this financial wellbeing pulse, then I suggest you should be. Seriously, Chris, that sounds like a, a very simple but quite genius idea in terms of measuring and calibrating all the things that we’ve been talking about on this podcast for the last eight years.

Chris Budd: Yeah. Well, thank you. I’m hoping it will have a big impact. The website, if people have a look, is called financialwellbeingpulse.com. And then if you’re interested, there’s a, you can register your interest. obviously, this podcast will be going out in a few weeks after we’re recording it, so I’m hoping by then there will be a demo that you can try. It might even be m. The whole thing is live, but certainly the website is live right now, so people can go and have a look and either register their interests or have a go.

David Lloyd: Great. Tom, are you going to be using that innovation?

Producer Tommo: We are. We’re part of the, would you call it beta phase or trial launch? Soft launch. So we. Chris, obviously introduced this, to us, quite a while ago, the concept, and we were like, yeah, let’s go for it. so, yeah, we’re very keen to embrace it. So, yeah, David, watch this space.

David Lloyd: Well, excellent. I look forward to filling out the questionnaire. Send it to me as soon as it’s up and running. we’ll see where my financial well being sits.

Producer Tommo: Yeah, it makes me a little nervous, doesn’t it?

David Lloyd: 0% official status, miserable. I don’t think that will be the case at all. Great. Well done, Chris. Another innovation for ovation. It’s never ending. right.

Chris Budd: I should just add something that this has also been developed. So there’s three organisations I mustn’t miss out. so, senator, thriving places and Aegon, and also the Institute for Financial Wellbeing, helped develop this as well.

David Lloyd: Great. Okay, we look forward to hearing more from that, and I’m sure we will in a future podcast. So, never mind future podcast. What’s on today’s podcast, Chris?

Chris Budd: Well, today, David, we’re going to look at a very interesting subject of perception. I’ll tell you a bit more in the introduction about why we’re looking at this, but it might sound like initially an odd thing to talk about in relationship to money, but actually it’s got huge relevance.

David Lloyd: Excellent. Well, I look forward to that. But before we move on to that wide ranging conversation, as I’m sure it will be, let’s have this, episode’s Tight Ass Tommo Tip. As you know, every episode of this podcast features sound financial advice from Tom Morris, who’s an absolute expert, may I say, may I use the word genius at, saving us all money? Before we move on to him, Chris, have you got anything to share with us, this week at all?

Chris Budd: Yeah, I will, actually. So last time I mentioned, my mum, who, Meany, Maureen, as you called her, who died just over a year ago.

Producer Tommo: And, to establish Meany Maureen about the way that she’s tight with money, we need to establish and make sure it’s not a character assassination.

Chris Budd: That’s very true, yes. Thank you, Tom. but she did something that. That was, really, really positive, really good, which is, she used to have. She used to squirrel away little pots of money. So she would put a quid here, a few quid there, into five or six different pots, so that when it came time for, I don’t know, going on holiday, she had some money to give to us kids for spending money. Or it could be that when the boiler broke down, she had a little bit of money squirrelled away. My dad was terrible with money. He’d spend it, like, whatever the analogy is. whereas mum would just kind of, before he knew it, would just put some money away. Now, this is actually a behavioural bias, which has a name, it’s called mental accounting and it’s a really positive and useful thing and you can use it now with things like, if you were to set up separate bank accounts and call that bank account something specific. So emergency fund is absolutely essential. Everybody should try and put some money in an emergency fund. Call it the emergency fund. It’s only for emergencies. Or if you’re saving up for holiday, call that your holiday fund. My mum used to do this, literally, with jam jars and bourgoids in them. But you can still do it now. It’s called mental accounting and it’s a really positive way to get financial well being.

David Lloyd: Excellent. Tommo what’s the big one this week?

Producer Tommo: it’s a practical one. Again, I’m so sorry. I’m sorry. This came, and I always like to give credit to how it came about. And this one came from, again, I think, like last episode, a friend of mine and Chris’s, a chap called Colin Lowe, is a well travelled man, is Colin, and he put us onto this website called easysim Global. And what this enables you to do is when you go and travel, it’s expensive to use your mobile phone and use data. And he was travelling to the States recently and he bought a sim. Buy a package. It’s various options on the website, so you can buy some data. and it’s a fixed price, say, like 30 quid, and that’s it. Rather than using your, mobile data that you have in the UK, that could be really expensive. It uses this and that’s how we travelled around without worrying about any roaming charges and getting hit by a really expensive mobile phone bill. So yeah, easysim global, if you’re travelling.

David Lloyd: Abroad, well, a, very good tip, that one. And it may not be very funny, but it’ll save us money. And that’s the whole point of the podcast, isn’t it?

Chris Budd: Is it, though?

Producer Tommo: I feel so guilty about actually practical, useful tips these days, Tomo, I’m speaking.

Chris Budd: At the Financial Therapy association conference in San Diego in May. So this is great. What’s it called again?

Producer Tommo: It’s called easysim Global. It looks like it’s part, you know, the easyjet group looks, so it’s part of that. But yeah, if you’re. You could buy 5gb for 13 quid. It’s remarkable value.

David Lloyd: Well, Chris, you must report back a on your fantastic trip to San Diego. That’s very exciting. But also, you know, get that sim, see if it’s actually saved you any money and then come back on a Future podcast and, and tell us all about it. And if any of the listeners at home have got any of your own money saving tips, we’re always, very keen to see them. You can either email in to us or you can tweet us on Twitter, or x, as I believe it’s called now. And there’s loads of other ways that you can get in touch with us and they’ll be all in the show notes at the very end of the episode. But now let’s move on, Chris, let’s get into this topic of perception. I’m intrigued. It’s a very interesting subject, but, I’m not sure how you’re going to link it to our relationship to money or to financial well being?

Chris Budd: Blame, Tammy, Producer Tammy, she read a, book called the 22 immutable laws of marketing by Albert Rees and Jack trout.

David Lloyd: Oh, that old classic. It never leaves my bedside. I must have read that a hundred times.

Chris Budd: So, one of the 22 laws in the book is the law of perception. And this line caught Tammy’s eye. Truth and perception become fused in the mind, leaving no difference between the two.

David Lloyd: now one of the lines you’ve mentioned a few times over these podcasts is that beliefs are not truth. So are, we in that space now?

Chris Budd: I think so, because I had to think a little bit about what that line meant. On the one hand, we’ve got reality, the state of things is they actually exist. And on the other hand, we have perception, how we interpret how things exist. Truth, at least in the sense of the quote, sits on the perception side. In other words, it’s our truth, not necessarily the actual truth.

Producer Tommo: I m think there’s a big relevance to money, where truth and perception become fused. To quote the book, naturally, I’ve not read it. It’s Chris nos Luddite, aren’t I?

David Lloyd: can you actually read?

Producer Tommo: Debatable. Well, I’m reading a script right now, so how about that?

Chris Budd: It’s a wooden oz moment. The curtain.

Producer Tommo: I ad lib, obviously. So, if we become convinced that something we perceive really is true, but that thing is not good for us, then this is what we call a self limiting belief. And this is something we’ve spoken about before. if we hold a self limiting belief about money, for example, that we always need more money to be happy, then this could make us focus on trying to obtain more money, rather than focusing on things that actually do make us happy. So I can see how perception and money could be connected.

Chris Budd: So, having been given the challenge to look at the subject of perception, let’s start by being clear what we’re talking about when we use that word perception. I’ve obviously googled it and got some definitions, and it’s a process by which we take information from the world around us and organise that information in order to understand it, though each of us will organise that information in our own way, through our own philtres and values. Reality, on the other hand, is an absolute term that describes how things really are. So, although our perception of the world around us will often be accurate, there will be times when our perception is, in fact, not reality.

David Lloyd: Well, now we’re getting into interesting philosophical territory here, because there are some philosophers who would argue that reality doesn’t actually exist. I think it was Nietzsche who said that, if a train is standing at a platform in a station, how do we know that its wheels are still there when we can’t see them? And people would argue, well, clearly they’re there because. Because the train would collapse, if the wheels weren’t there. And Nietzsche said, well, how do we know that something else isn’t happening, that those wheels disappear? And some meaningless, force that we don’t understand comes and holds that train up? And people would go, well, we could go around there, we could see the wheels and prove that the wheels are holding the train up? And then Nietzsche said, well, yeah, but how do we know that the minute that we go and look at them, this strange, mysterious force disappears, and the wheels come back. And he argued that we don’t know things that we can’t see, and everything is always up for interpretation. so reality is, we perceive it doesn’t actually exist, because we all experience life in our own individual ways.

Producer Tommo: I don’t wonder if the listeners are feeling this way. I certainly. It feels like I’m in the middle of a matrix film.

Chris Budd: I’m actually very open to this. So just, touch on one thing, which I was discussing with some friends at the weekend, who weren’t having any of it, which is, I’m quite tempted to become a member of the flat Earth society, because, Hear me out, hear me out. Because the flat Earth society, if I’m reading it correctly, and you do have to read between the lines a little bit, but I don’t think it’s actually about believing that the earth is flat, although they are adamant that that is what it’s about. But I don’t think it is. I think it’s actually about a willingness to challenge and be open minded, and I think that’s quite healthy. So have a look at their website and see what you think. it’s intriguing. Anyway, listen, we’ve establishing the principle.

Producer Tommo: Can I just establish the financial wellbeing podcast does not believe that the earth is flat. Please. And we’re not attacked here, given too much countenance, that. But I get your point, Chris. Sorry.

Chris Budd: it’s just trying to establish a principle that we should question things that what we think of as reality might not actually be real, which is not a bad way to go through life.

David Lloyd: Yeah, but does this mean that we will always be wrong? I mean, if we can’t always be right, then does that mean that we’re always wrong?

Chris Budd: Well, I think it depends whether the issue in question has one answer or allows for nuances of opinion. So, you and I, David, would say that the Beatles are the best group ever. Tomo, on the other hand, might say that oasis are better.

David Lloyd: Well, he’d be wrong, obviously.

Chris Budd: Well, of course he would. Without the Beatles, there would be no oasis.

Producer Tommo: Right, Boomers?

Chris Budd: Is that all you can come back with, Boomers?

Producer Tommo: that’s all I got. That’s my stock response. Chris, let’s agree to disagree. The Beatles were your thing. The oasis is. Oasis is mine. It’s a generational thing.

David Lloyd: I really like oasis, but they’re obviously not as good as the Beatles. But, I think what Chris is saying is that our perceptions, whatever they might be, can be flawed.

Chris Budd: Exactly. Exactly. What’s interesting and what might help us to understand our own relationship with our finances is to understand how our perceptions might be flawed, what is going wrong in the process, and is it causing a problem?

David Lloyd: Okay. Right, I’m up for this. In fact, I’d like to go first, if I may. So, one way in which our perceptions could be flawed is if we only rely on one source of information. If Tommo were only to listen to Oasis and never experienced the glory of the Beatles album revolver or sergeant Peppers, or many of the other great albums that they made, then his perception that oasis are better would be understandable. If that was his only term of reference.

Chris Budd: Exactly. Yeah. Great example. Great example. Let’s take another example. let’s say somebody’s walking down a suburban street and they smell cut grass. Your perception would understandably be that there’s a lawn nearby that’s been mown. But in fact, it could be that there are other explanations. Someone might have dropped a bottle of fabric conditioner nearby, for example.

David Lloyd: Okay, so, if the person was only using one sense, that of smell, then that’s what they would perceive and that’s what they would understand. But if they used their ears, maybe to hear the bottle smash, and their eyes to see what had smashed, then they would have realised that the smell came not from the mowed lawn, but from the drop bottle of fabric conditioner.

Producer Tommo: Yeah, it’s matrix stuff, isn’t it? Yeah. They were also relying on their previous experiences. The smell of the cut grass is far more likely to be the cause than the bottle of the air freshener, because of their previous experiences.

David Lloyd: Yeah, but that’s an assumption then, isn’t it?

Chris Budd: and we’ve got to make assumptions in life, because without assumptions, we couldn’t live, you know, we couldn’t go about our daily life. If we looked around us to make sure that everything we smell is coming from what we expected to come from, we wouldn’t be able to function.

David Lloyd: But looking at this from a different perspective, if instead of smelling cut grass, I smell gas, something in my brain immediately alerts me that there might be a problem. and if I smell something innocuous, on the other hand, well, I might not even notice it until somebody points it out to me.

Chris Budd: So this is because our brains have only limited capacity, so we only pay attention to things that are important to us, and we build shortcuts in order to focus on essential things, either that we want or need or that are harmful to us. But if our attention, the things we choose to notice the, choose to notice the ones, the things that we perceive. if our perceptions are too much on one thing, we might not notice something else that is actually more important.

Producer Tommo: M so I remember seeing a documentary about how unreliable eyewitnesses are. They set up an experiment where a dozen or so people were told to jog around a park. And as they ran, they also needed to count their steps. The researchers pretended that they wanted to know how many steps each of them took. However, halfway around, the researchers had set up some actors to stage a mugging just to the side of the path they were running on. So the joggers each ran within five metres of someone being attacked at knifepoint, violently, by two muggers. So you think, quite obvious that you spot it. But amazingly, when they went back to the researchers, not one of the joggers reported that they had noticed anything unusual. They were so busy concentrating on counting their steps that they didn’t notice the mugging.

Chris Budd: I once almost had an accident. David Yulnay, just by the cricket club that we, coached kids at for many years. opposite that, lots of lorries come out from the quarry and a lorry came out in front of me once, and obviously didn’t see me, and I swerved and there’s a telegraph pole. And I ended up literally an inch before the telegraph pole, real close one. And I got out of the car, was really quite shaken, and I looked up the road and I recognise a car from one of our friends, coming down the road. And I thought, oh, that’s good, she’ll stop. And, and she just drove straight past. And I thought, that’s a bit rude, you know. And I saw her about a week later and I mentioned, you know, why didn’t you stop? She didn’t see me. I was up on the bank, on the curb of the side of the road, and it looked like I would slammed into a telegraph pole. But whether she was listening to the radio or just concentrating on driving, she didn’t even see me. So this is a phenomenon known as inattentional blindness, where we fail to notice something because we’re distracted. Our brains use loads of these shortcuts and we don’t even know we’re doing it. another example, there’s a book called the Elements of eloquence by Mark Forsyth, all about how to speak with a bit of flourish. And there’s a passage that went viral a few years ago, all about the order in which we use adjectives in front of a noun. This is quite fun. I really like this. I love words. So, let’s say you want to describe a pot. You might say that it’s a coffee pot. Or maybe you’d say that it’s a green coffee pot or a green danish coffee pot. These adjectives must follow a certain order, or we won’t understand the sentence. The order that they must follow is opinion, size, age, shape, colour, origin, material, purpose, and then the noun.

Producer Tommo: Right.

David Lloyd: Okay. Now, I think I’ve come across this before, but that’s a lot to process. Chris, can you say that again?

Chris Budd: So let’s, It’s opinion, size, age, shape, colour, origin, material, purpose, noun. And if you don’t get it in that order, your, brains can’t cope with it. So let’s give this as an example. David, I’m about to send you a message with a description I want you to read out. And most importantly, don’t read it first in your head. Just read it out straight away. Okay, you ready? Yeah. Okay, I’ve sent it.

David Lloyd: I’ve bought myself a lovely little old, oval, green danish coffee pot.

Chris Budd: Okay, now, tomo, I’m sending you a message. Same thing. Just read it straight out, first time. Ready? It’s gone.

Producer Tommo: I’ve bought myself a danish little coffee. Oval, old, silver. Lovely potato.

Chris Budd: So exactly the same word.

Producer Tommo: I tried my hardest not to do that in a bristolian accent. Then silver. Lovely.

Chris Budd: So, look, it’s exactly the same words, but in a different order, and it becomes gobbledygook. Not only does that second arrangement of the words not make any sense, it’s actually hard for Tomo to say it. So we do this complicated manoeuvre automatically, without any conscious effort at all. As long as we all stick to the same system, we will interpret information in the same way. But as soon as we get information that breaks those rules, we’re lost.

Producer Tommo: by the way, I think it’s worth pointing out that the perception gap isn’t always a bad thing. If I think I can do something I can’t, this might encourage me to be aspirational and therefore to learn.

David Lloyd: Very true. Okay, I think a quick recap is in order, Chris, which is my wife saying, it’s time for you to get to your point.

Producer Tommo: Please, for the love of God, please.

David Lloyd: So, let me see if I’ve got this. There is reality, and then there is our perception of reality. And these two things are not always the same. Okay, I’ve got that. That’s the perception gap. and this gap could be down to one or more of many reasons, such as, assuming what has happened before will happen again, using only one source of information, being distracted, and relying too much on systems that we develop without realising it.

Chris Budd: Bang on. Bang on. So let’s take a look at how our perception of the information around us when it comes to money doesn’t always reflect reality.

David Lloyd: Here it comes. I sense a point about to be made.

Chris Budd: Okay, first, a quick reminder. Do you remember we talked about setpoint theory from academic Sonia Leibomirsky, which says that 40% of our long term wellbeing is down to our intentional activity?

Producer Tommo: We’re 50% inherited, leaving only 10%, which is down to our circumstances, such as wealth.

Chris Budd: So the really positive message from that is that we can affect our long term well being with our intentional activity. So let’s bear that in mind and then look at how our perception gap when it comes to money can be changed, accepting that we need to spend a bit of time on it. This is the sort of intentional activity I think that Professor Ole Bermirsky was talking about.

David Lloyd: Okay, so let’s look at those reasons for a perception gap that we’ve identified and see what we might be able to do about them. we’ve got assumption, one source of information, distraction, and our brains shortcuts. I think I’ve got that right. Tommo, what are the common assumptions that you hear clients making. So let’s begin with assumption. Let’s turn to the man on the ground who sits in front of clients, helping them all day, every day. Tomoe, what are the common assumptions that you hear clients making?

Producer Tommo: There are lots of things, people think that they can’t do when they first come to see us. that’s a big assumption, is what they can’t do. and they might say, I can’t afford to do that, or maybe I can’t retire until I get the state pension. Some real common things that come up time and time again.

David Lloyd: Is that why they’ve come to see you?

Producer Tommo: actually, not always, but very often they come for specific reasons, such as, I’ve got these pensions, what should I do? Them or because they might have inherited some money. But, once we start talking about their future, these limitations about their options start to reveal themselves. So we gently challenge their assumptions and often start to find that they might be able to do more than they thought they could do.

David Lloyd: And, ah, how do you go about demonstrating that?

Producer Tommo: Well, this is a key thing about trying to, break assumptions, right word, to use quite aggressive, break assumptions is you got to prove it. Well, that actually comes from the second cause of the perception gap that you listed of, only looking at limited sources of information. Quite often, for example, someone, will receive their annual statement from, their pension company, and it will show a projected pension income. And they conclude that they can’t afford to retire on that. But there are other sources of information we could use, other options to consider. we could look to use other sources of income or possibly downsizing or changing jobs, or quite frankly, taking the pension in a very different way to that prescribed figure, that they see on their statement. So, there are lots of different bits of information that we need to consider, rather than just that one bit of information they’ve hung their hat on.

Chris Budd: And that unintentional blindness, the distraction comes in here as well, could be the money distractions that are around us, whether that be social media, advertising, all those lovely records that we might want to buy. That might be just me, I admit.

Producer Tommo: M but there’s that kind of example for everyone, right? It’s, often just as simple as the fact that we’re just so busy getting on with our daily lives that we don’t look up. I’m a financial advisor by profession, but I’ve got young family, my head’s down getting through the daily life and making sure everybody, stays alive. but that’s why engaging someone else can be so helpful. It helps us to challenge our assumptions and create more options.

Chris Budd: And, having financial options is one of the five pillars of financial well being. And I’d also just say having a third party also kind of keeps you, to the plan.

Producer Tommo: It might surprise people to know that I am the financial planner for other financial planners or others in financial services, because they will openly say it’s just spotting some of those blind spots or some of their perceptions that might not be reality. I know, Chris, I’m sure you don’t mind. You yourself, you were a financial advisor for an awful long time, and you engaged in a, I keep interchange of financial advisor and planner. It’s often deemed the same thing. But you engaged in a financial planner as well, haven’t you?

Chris Budd: Yeah, absolutely. I paid that. We had our annual review meeting just the other day, and asked, me questions that one of the things that happens when you as a couple sit in front of your financial planner is your partner says something that quite takes you by surprise. I would always recommend, if possible, that, if couples, if you do run your finances jointly, which not everybody does, but if you do have your meeting together and talk about your future together and have challenging questions asked of you. It doesn’t need to be aggressively challenging. It could just be, what’s your plan for the next five years? And you might be surprised what the other person says.

David Lloyd: Yeah, no, and I’ll back that up as well. So myself and my partner, we do that with Tomo. We’ll sit and we’ll talk together, and sometimes I’ll say something and she’ll go, oh, really? I didn’t know that you were thinking that way, or vice versa. But, it’s very, very useful to get those things out there. And we touched on this, if you remember, the very last podcast with, Nick Elston, when he was talking about, for a whole variety of reasons, the benefits of getting third party advice. and I think money, is obviously really, really important. So this just leaves us with those shortcuts that the brain takes in order to handle the amount of information that it receives. And we’ve had a huge amount of information that we’ve tried to process in this podcast today.

Chris Budd: This is the. So we’re trying to narrow this perception gap and the shortcuts. This is where we’re going to come onto some of the behavioural biases that we’ve covered these before. We, had Neil Beige has been on several times, and we had Bage’s biases. This is shortcuts that our brain takes, which were developed over millennia to keep us safe, but they can sometimes work against us.

David Lloyd: Now, without going too deeply into this, can you remind us of one of those, Chris?

Chris Budd: Yeah, let’s take confirmation bias. It’s quite a good one for this topic on perception gap. This is where confirmation bias, where we seek only information that confirms our current thinking. So somebody who might be left leaning in their politics would tend to read the Daily Mirror. Let’s say somebody right leaning in their politics might read the daily mail, and you’re not going to get anything from either paper that’s going to challenge your existing assumptions and how you think. So, confirmation bias limits the information that we receive, which therefore maintains any gap that might exist between perception and reality.

Producer Tommo: Which comes back to why it’s really important to have a third party helping you to make those big financial and life decisions.

David Lloyd: Well, we’ve unpacked an awful lot in this conversation. It’s been a very interesting philosophical and indeed metaphysical conversation, and I hope you’ve learned something from it yourselves, and I hope you’ll be able to apply that to the way in which you work. As you, I’m sure always do in increasing your financial well being. Which is why, of course, you listen to this podcast, and indeed, I hope that you will do that again the next time we release another one of these fascinating financial wellbeing podcasts.

Podcast (podcasts): Play in new window | Download (Duration: 33:33 — 76.8MB) | Embed

Do you have any financial wellbeing questions you would like us to answer? Or do you have a #tightasstommo money saving tip you would like to share with our listeners?

If so, let us know by going to Twitter @Finwellbeing or email – contact@financialwell-being.co.uk

If you would like to purchase a copy of The Financial Wellbeing Book please click on this link to visit Penny Brohn UK shop